41 zero coupon bond accrued interest

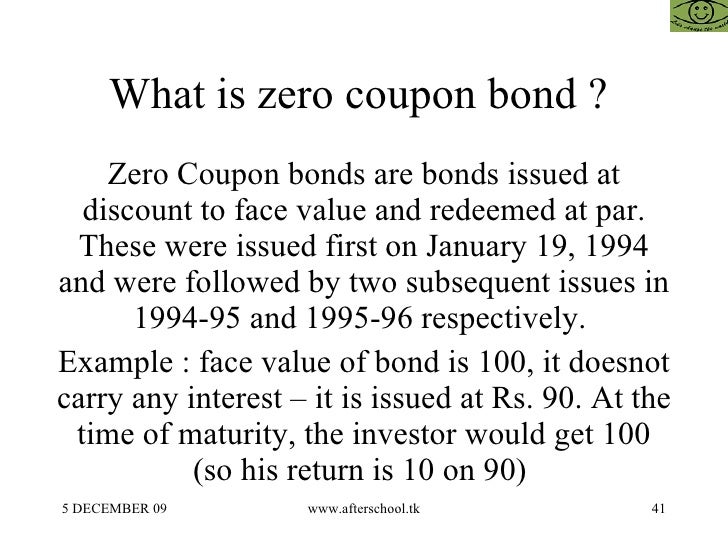

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond. How to Calculate PV of a Different Bond Type With Excel - Investopedia 20/02/2022 · The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. ... A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a ...

How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the...

Zero coupon bond accrued interest

What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon... Bond Formula | How to Calculate a Bond | Examples with Excel … Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if … Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Zero coupon bond accrued interest. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Deep Discount bonds and Zero Coupon Bonds - The Fixed Income A cumulative product provides clarity of coupon paid. The taxation of the returns depends on the tax treatment prescribed at the time, varying from being taxed at maturity or on the accrued interest being taken up for tax in the year it is earned. Another avatar of the deep discount bond is the zero-coupon bond (ZCB).

Zero Coupon Bonds - CMT Association Zero Coupon Bonds. These bonds are sold at a deep discount from the value of the bond at maturity. They pay no current interest rate. U.S. savings bonds are issued in a like manner. There are tax obligations due on those bonds for accrued interest and they must be paid. Sometimes Treasury bonds are stripped of their coupons and sold as zero ... Zero Coupon Bonds | Alamo Capital Buy Zero Coupon Bonds. If you are interested in buying zero coupon bonds, contact Alamo Capital by phone at (877) 682-5266 - or - (877) 68-ALAMO, by email at information@alamocapital.com, or by filling out the form below. Our experienced zero coupon bond specialists can provide you with information about the current inventory of zero coupon ... Asset swap - Wikipedia From the perspective of the asset swap seller, they sell the bond for par plus accrued interest ("dirty price"). The net up-front payment has a value 100-P where P is the full price of the bond in the market. Both parties to the swap are assumed to be AA bank credit quality and so these cash flows are priced off the Libor curve. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned. › articles › investingHow to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. ... A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a ... Accrued Interest | What It Is and How It's Calculated - Annuity.org So, the formula to calculate accrued interest is: Face Value x (Coupon Rate ÷ 365) x Accrual Period That means an investor who sells a $100,000 bond with a 4 percent coupon 63 days after the bond's last payment date would receive $690.41 in accrued interest from the bond's buyer.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period.

Zero coupon municipal bonds maturation - ttlc.intuit.com The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. That means you have to calculate the portion of the difference between the purchase price and face value that accrued to you. $500 x 0.0705 = $35.25 ...

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

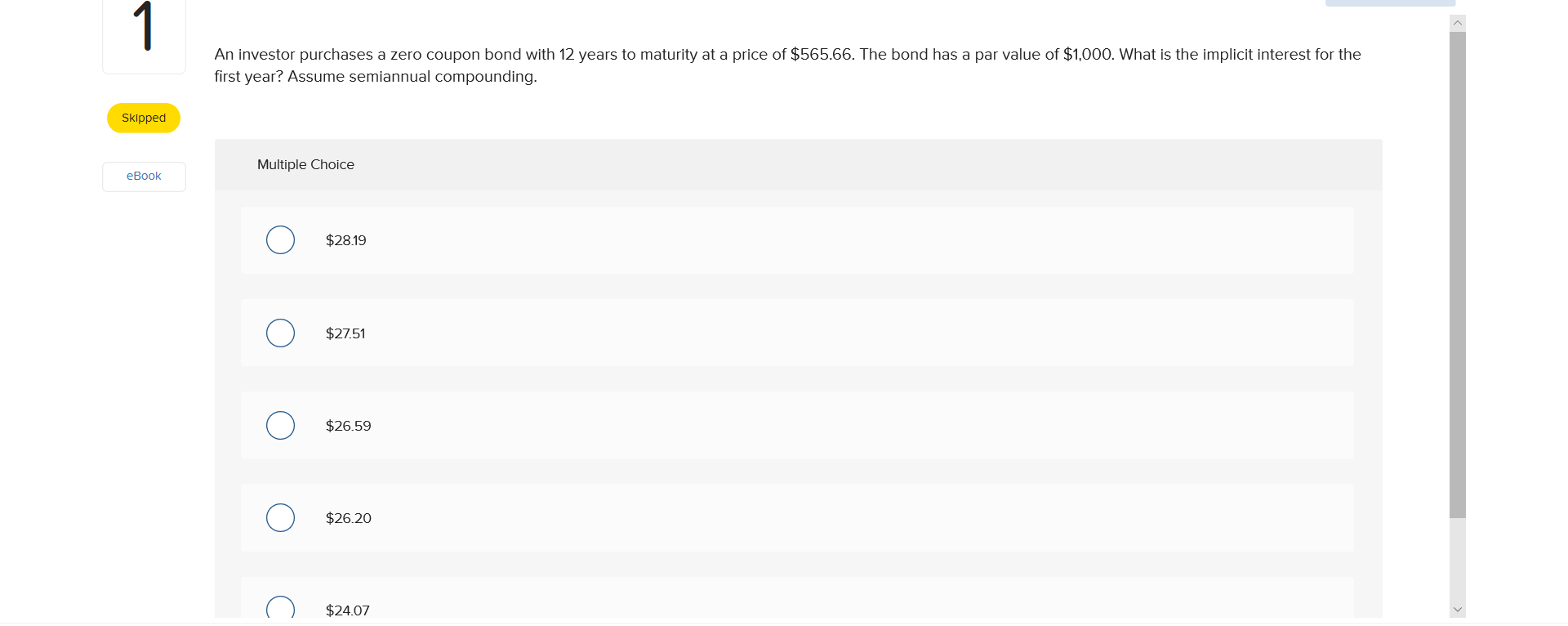

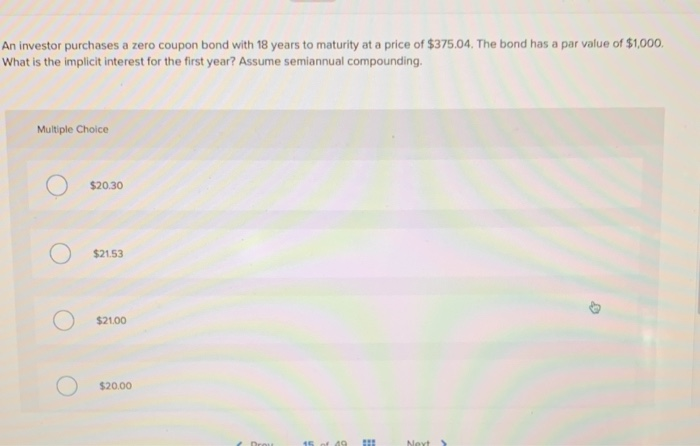

Imputed Interest - Overview, Calculation, Tax Implications 18/05/2021 · For zero-coupon bonds, the imputed interest is calculated as accrued interest based on the yield to maturity. Calculating Imputed Interest. Tax Implications – Base Scenario ... For example, a borrower issues a zero-coupon bond at a discount of $2,500 with a face value of $10,000, quarterly accruals, and a maturity of two years. At inception ...

corporatefinanceinstitute.com › imputed-interestImputed Interest - Overview, Calculation, Tax Implications May 18, 2021 · In filing tax returns, zero-coupon bonds are required to declare the imputed interest. The imputed interest for the year on zero-coupon bonds is estimated as the accrued interest rather than the minimum interest like in below-market loans. It is calculated as the yield to maturity (YTM) multiplied by the present value of the bond. The value of ...

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet The interest accrues at the interest rate you obtained when you bought the bond. Using the earlier example, if you paid $500 for a 10-year, $1,000 bond getting an interest rate of 7.05%, you would...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Clean Price - Clean price is the price of the bond if accrued interest is ignored. This calculation relies only on the difference between market price and the coupon rate of the bond. Accrued Interest - For convenience, we have explicitly calculated the amount of the market price that is due to accrued interest. If you subtract this from the ...

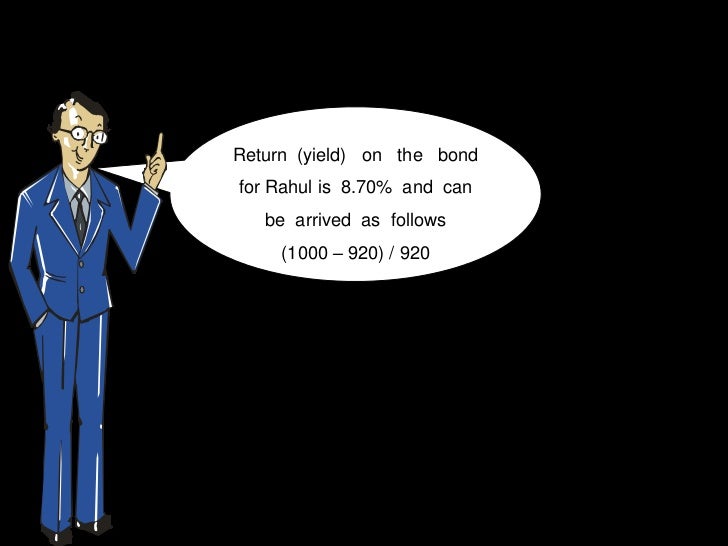

What Is Bond Yield? - Investopedia 31/05/2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

Bond Pricing and Accrued Interest, Illustrated with Examples Steps to Calculate the Price of a Zero Coupon Bond Total Interest Paid by Zero Coupon Bond = Face Value - Discounted Issue Price 1 Day Interest = Total Interest / Number of Days in Bond's Term Accrued Interest = (Settlement Date - Issue Date) in Days × 1 Day Interest Zero Coupon Bond Price = Discounted Issue Price + Accrued Interest

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

23. Accrued Interest You purchase a bond with a | Chegg.com Accrued Interest You purchase a bond with a coupon rate of \( 6.4 \) percent, a par value of \( \$ 1,000 \), and a clean price of \( \$ 1,027 \). ... Imagination Dragons Corporation needs to raise funds to finance a plant expansion, and it has decided to issue 25-year zero coupon bonds with a par value of $1, 000 each to raise the money.

Accrued Interest - Bond Dirty Price vs. Clean Price - GlynHolton.com It is the bond's accrued interest. Exhibit 2: A bond's market value (dirty price) can be disaggregated into a clean price and accrued interest. If we add the two graphs of Exhibit 2 together, we get the graph of Exhibit 1. We called the quantity depicted in Exhibit 1 the bond's market value, but another name for it is the bond's dirty price.

iBond - An Intelligent Bond Solution Calculation. provides a full coverage of bond pricing based on updated standards and conventions of Thai bond market. The results display an informative and complete data such as clean price and gross price, accrued interest, discount margin, days counted, sensitivity analysis, terms, features and their cash flows.

Post a Comment for "41 zero coupon bond accrued interest"