38 coupon paying bond formula

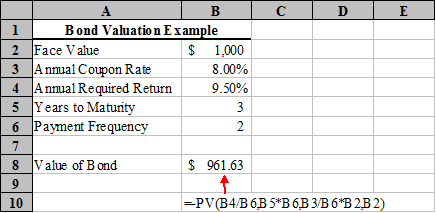

How to Calculate a Coupon Payment - wikiHow 7 steps1.Get the bond's face value. The first piece of information is the actual face value of the bond, sometimes called its par value. Note that this value might ...2.Locate the bond expiration. You'll also need to locate the bond expiration or maturity date. That way, you can get a sense of how long you'll be receiving ...3.Find the bond coupon rate. The coupon rate is usually expressed as a percentage (e.g., 8%). You'll need this information, also provided by your broker, to ... How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

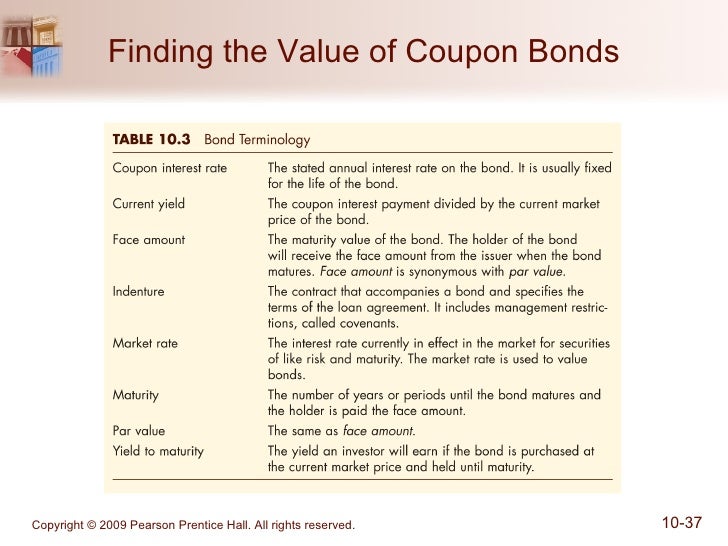

Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ...

Coupon paying bond formula

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Calculation of the Value of Bonds (With Formula) If the coupon rate of interest on a Rs. 1000 per value perpetual bond is 7% what is its current yield if the bond's market price is Rs. 700? Current yield = 70/700 = 10% If the bond sells for Rs. 1400 the current yield will be 5%. (2) Yield on bonds with maturity period: Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

Coupon paying bond formula. Bond Formulas - thismatter.com C = coupon payment per period; P = par value of bond or call premium; n = number of years until maturity or until call or until put is exercised; Y = yield to maturity, yield to call, or yield to put per pay period, depending on which values of n and P are chosen. Coupon Rate Formula & Calculation | Coupon Rate vs ... A coupon rate, or the coupon payment, refers to the fixed interest payment paid by bond issuers to bondholders. Usually, bonds offer coupon payments that are paid semiannually and have a par, or ... Deferred Coupon Bond | Formula | Journal Entry | Example ... Deferred Coupon Bond Example. Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

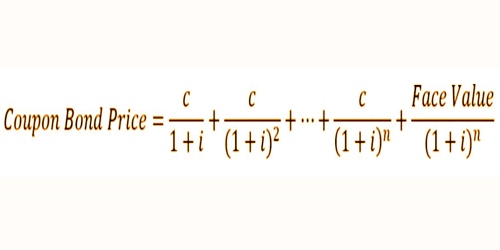

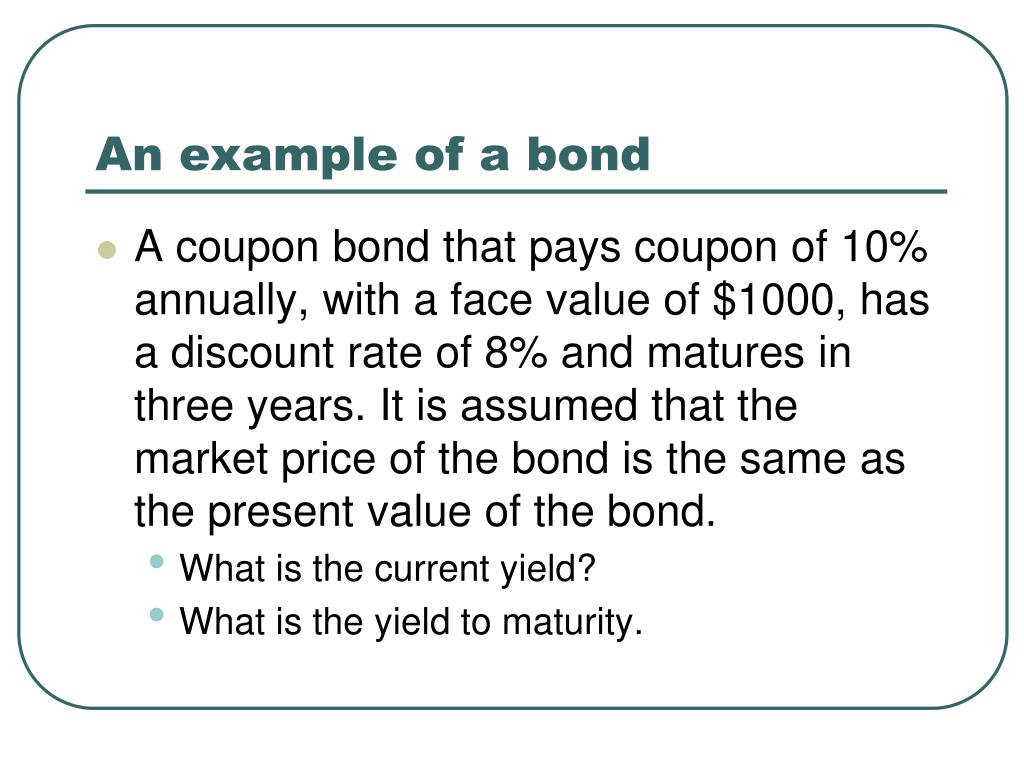

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Calculate Price of Bond using Spot Rates | CFA Level 1 ... Sometimes, these are also called "zero rates" and bond price or value is referred to as the "no-arbitrage value." Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

PDF Bond Pricing Formula - Final - JSE The GCH formula only applies to "conventional" bonds - ie. those paying fixed (including zero) coupons, and with two coupon payment dates per year, one of which coincides with an anniversary of the bond's maturity date, on which date the whole capital of the bond is redeemed. Bonds which fail to meet one or more of these criteria cannot be ... Zero Coupon Bond: Definition, Formula & Example - Video ... The formula is price = M / (1 + i )^ n where: M = maturity value or face value i = required interest yield divided by 2 n = years until maturity times 2 Zero coupon bond prices are typically... › coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Formula | How to Calculate a Bond | Examples with ... Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity

Coupon Payment Bond Formula - thmc.info Coupon Payment Bond Formula, Appliances Online Au Coupon, Joanns Fabric Coupons App, Harris Teeter Super Double Coupon Schedule 2019, At&t U Verse Movie Coupons 2019, Swanson Vitamins Coupon Codes 2020, Deals Genius

Bond Yield Formula | Step by Step Calculation & Examples The annual coupon payment is calculated by multiplying the bond's face value with the coupon rate. Calculate Bond Yield Let us understand the bond yield equation under the current yield in detail. Bond Yield Formula = Annual Coupon Payment / Bond Price Bond Prices and Bond Yield have an inverse relationship

What is a Coupon Payment? - Definition | Meaning | Example Despite the attractive return, he decides to purchase $10,000 of the US Treasury Bond. Now, how will this affect his $10,000 principal? Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall.

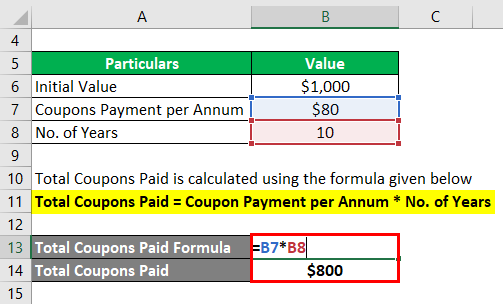

Coupon Bond Formula | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity

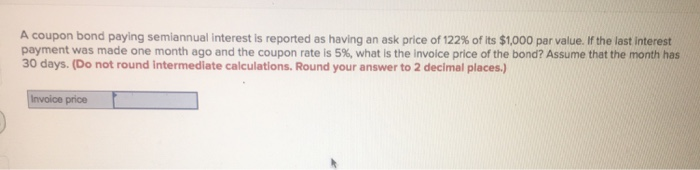

How to Calculate the Price of a Bond With Semiannual ... Calculating the price of a bond with semiannual coupon payments involves some higher mathematics. Essentially, you'll have to discount future cash flows back to present values. ... To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return ...

How to Calculate the Bond Duration (example included ... Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ...

How do you calculate CPN finance? - FindAnyAnswer.com A bond's coupon rate can be calculatedby dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Click to see full answer People also ask, what is the formula for calculating coupon rate?

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

Calculation of the Value of Bonds (With Formula) If the coupon rate of interest on a Rs. 1000 per value perpetual bond is 7% what is its current yield if the bond's market price is Rs. 700? Current yield = 70/700 = 10% If the bond sells for Rs. 1400 the current yield will be 5%. (2) Yield on bonds with maturity period:

Corporate Finance_179 - 35 Duration of a coupon paying bond with same maturity is A equal to its ...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Post a Comment for "38 coupon paying bond formula"